The Rise of Digital Wallets: Transforming Payments and Financial Access

Digital wallets are revolutionizing payments, making transactions faster, safer, and more accessible worldwide.

Digital wallets are changing how people pay, offering greater financial inclusion.

The way we handle money has evolved dramatically over the years, and digital wallets are at the forefront of this transformation.

As technology advances, physical cash and even traditional banking methods are gradually giving way to more efficient, secure, and accessible payment solutions.

Digital wallets allow users to store payment information electronically and make transactions with just a tap or a click.

From small everyday purchases to large financial transactions, they are reshaping the global economy.

The rise of digital wallets is driven by the increasing demand for convenience, security, and financial inclusion.

Whether it’s paying for groceries, sending money to a friend, or managing subscriptions, digital wallets have become an essential part of modern financial life.

But what exactly is fueling their rapid growth, and what does the future hold for this technology? Let’s explore the factors behind their expansion and how they are shaping the way we handle money.

The Growth of Digital Wallets

Digital wallets have gained massive popularity due to their ease of use and widespread accessibility.

With the proliferation of smartphones and internet connectivity, millions of people now rely on digital wallets for their daily transactions. Companies like Apple Pay, Google Wallet, PayPal, and regional platforms such as WeChat Pay and Paytm have revolutionized payments by eliminating the need for physical cash or cards.

Several factors contribute to this surge in adoption:

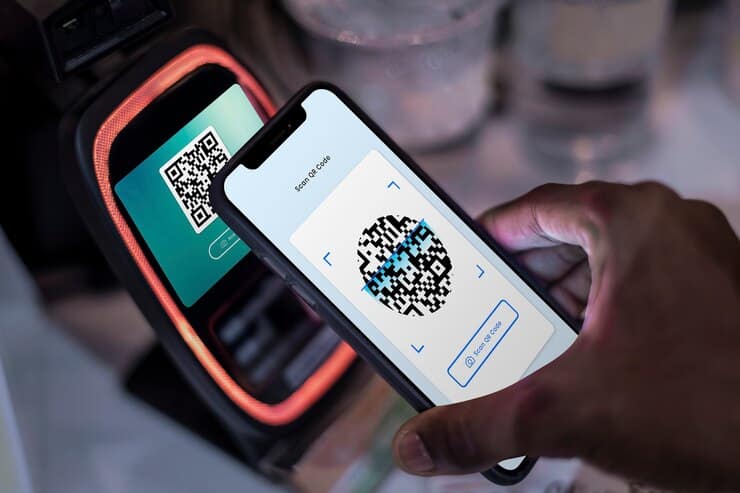

- Convenience and Speed: Digital wallets enable users to complete transactions in seconds, whether online or in-store. Features like contactless payments and QR code scanning have further simplified the process.

- Enhanced Security: Advanced encryption and biometric authentication reduce the risk of fraud and unauthorized access, making digital wallets safer than traditional cards or cash.

- Financial Inclusion: Many people who lack access to traditional banking services can now participate in the financial system through mobile wallets.

- Integration with Other Services: Digital wallets are not just for payments. They allow users to store loyalty cards, transit passes, and even cryptocurrencies, enhancing their overall functionality.

Digital Wallets and Changing Consumer Behavior

The increasing reliance on digital wallets has also altered consumer spending habits.

As people embrace a cashless lifestyle, businesses have adapted by integrating digital payment options.

Retailers, e-commerce platforms, and even street vendors now accept digital transactions, catering to a growing population that prefers the speed and simplicity of mobile payments.

Additionally, digital wallets have contributed to the growth of subscription-based services. Many consumers now use them for automated payments on streaming platforms, food delivery services, and cloud storage, ensuring uninterrupted access to their favorite services.

The Role of Digital Wallets in the Global Economy

Beyond individual consumers, digital wallets are reshaping economies worldwide.

They enable cross-border transactions with minimal fees, making international trade and remittances more efficient. In regions with underdeveloped banking infrastructure, digital wallets serve as an essential financial tool, empowering small businesses and individuals to participate in the digital economy.

Governments and financial institutions are also recognizing the potential of digital wallets.

Some countries are developing central bank digital currencies (CBDCs) that can be integrated into existing digital wallet platforms, further streamlining monetary transactions.

Challenges and the Future of Digital Wallets

While digital wallets offer numerous benefits, they also present certain challenges:

- Cybersecurity Risks: As digital transactions increase, so do threats like hacking and identity theft. Continuous innovation in security measures is necessary.

- Regulatory Issues: Governments and financial institutions must establish regulations to prevent fraud and ensure consumer protection.

- Adoption Barriers: Some people are still hesitant to transition to digital wallets due to lack of awareness or technological literacy.

Looking ahead, digital wallets will likely integrate with emerging technologies such as artificial intelligence and blockchain, enhancing efficiency and security.

The expansion of 5G and IoT devices may further streamline payments, making digital wallets an even more indispensable part of daily life.

Conclusion

The rise of digital wallets marks a significant shift in the financial landscape. They offer convenience, security, and accessibility, making transactions easier for individuals and businesses alike.

As technology advances, digital wallets will continue to play a crucial role in shaping the future of payments and financial inclusion.

Whether you’re a consumer or a business owner, embracing this innovation can unlock new opportunities in the ever-evolving digital economy.