Learn tips to improve your credit score quickly

Discover quick tips to improve your credit score fast! Simple strategies to boost your financial health and achieve your goals sooner.

Quick and Effective Tips to Boost Your Credit Score

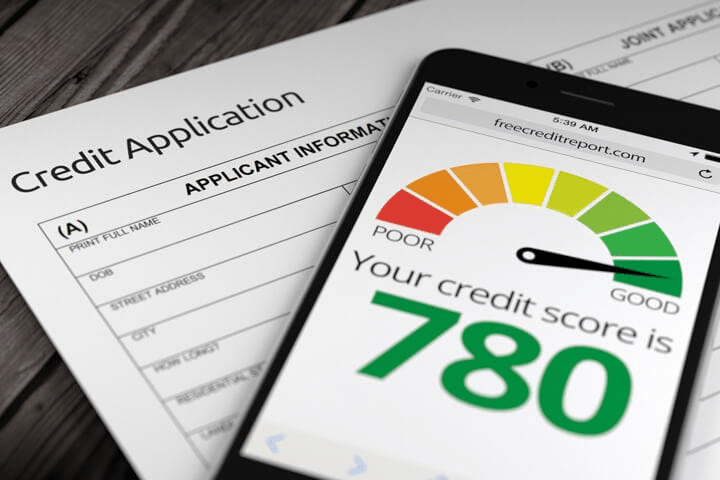

Have you ever stopped to think about how your credit score can impact your financial life? Whether you’re looking to get a loan, make installment purchases or even negotiate better interest rates, a good score can be the key to opening many doors.

But there’s no need to worry about improving your score. There are some simple, practical steps you can take in your day-to-day life to see your score grow. In this article, we’re going to share some valuable tips to help you clear your name and make it easier for you to make purchases or seek credit. Let’s go?

How can you improve your credit score?

If you’ve ever had trouble getting a credit card or a loan, you’ve probably realised the importance of maintaining a good score.

And the good news is that improving your score isn’t as difficult as it sounds! With a few simple actions and changes in your financial behaviour, you can achieve a higher score and gain more freedom to achieve your goals.

1. Pay your bills on time

It may seem obvious, but many people still fail to pay their bills on time, which has a direct impact on their credit score. Every delay, however small, can cause your score to drop.

This is because credit companies monitor your payment history and use this information to calculate your score. So don’t put off until tomorrow what can be paid today!

One tip is to set up reminders on your mobile phone or automate the payment of your bills, so you never miss a deadline and keep your score up.

2. Control your spending and avoid credit card arrears

The credit card is one of the most common forms of credit, and using it responsibly can go a long way towards increasing your score. A good tip is to try to keep your card use within 30 per cent of the total limit.

If you exceed this amount, your score could suffer, as this indicates that you may be getting into debt. Also, avoid paying only the minimum amount of the bill. Although this will ease your pocket in the short term, the debt will accumulate interest, which will harm your financial health and your credit score in the long term.

3. Regularise outstanding debts

If you have any outstanding debts, settling them is one of the most important steps towards improving your score.

By paying off a debt, you not only reduce the negative impact it has on your score, but you also begin to rebuild your credibility with financial institutions.

If the debt is very high, try to negotiate an instalment plan with the creditor company. In many cases, you may be able to get more affordable conditions to pay off the amount in instalments and thus prevent the debt from further damaging your score.

4. Have a longer credit history

The credit score also takes into account the length of time you have had a relationship with financial institutions.

The longer you keep accounts or credit cards in your name responsibly, the easier it will be to improve your score. This is because financial institutions see customers with a long credit history as less risky.

So when opening new accounts or applying for new cards, think carefully. Opening several accounts in a short period can reduce your score, as this shows instability.

5. Use the positive record in your favour

A positive credit record is a tool that allows credit companies to see not only your arrears, but also your good financial behaviour. In other words, if you pay your bills on time, this will be registered in your name and can help increase your score.

The positive register is a great opportunity for those who have a good track record but don’t yet have a high score. Check to see if you are enrolled in this system and use this advantage to demonstrate your commitment to payments.

6. Monitor your score regularly

As with any financial goal, monitoring your credit score is essential to know if your actions are paying off.

Several services offer free credit score consultations, allowing you to see how you’re performing and whether you’re on the right track.

Monitor your score closely to identify what is having a positive impact and what needs to be adjusted.

7. Have patience and consistency

Improving your credit score won’t happen overnight. The key to success in this process is patience and consistency.

Over time, by paying your bills on time, controlling your spending and settling your debts, you’ll see your score rise. Remember: the important thing is to take the first step and move forward with your financial planning.

Improving your credit score may seem like a challenge, but with the right tips, you can achieve a higher score and make your financial future easier.

With small changes in your financial behaviour, such as paying bills on time, controlling credit card use and settling outstanding debts, you’ll be on the right track.

Finally, remember: maintaining a good credit score requires discipline and consistency, but the benefits are worth it. Start today and enjoy the advantages of having a good financial history!