AI in Personal Budgeting: Smarter Money Management with Technology

Discover how AI is transforming personal budgeting with automated tracking, spending insights, and financial forecasting.

Take control of your finances with AI-powered personal budgeting tools

Managing personal finances has always been a challenge, but advancements in artificial intelligence (AI) are making it easier than ever to track expenses, set goals, and optimize budgets.

AI-powered tools are transforming personal budgeting by providing real-time insights, automating expense categorization, and offering predictive financial advice tailored to individual needs.

As technology evolves, AI is becoming an indispensable financial assistant, helping people make informed financial decisions with minimal effort.

The Role of AI in Budgeting

AI-driven budgeting applications leverage machine learning and data analytics to provide a comprehensive view of financial health. By analyzing income, spending habits, and financial goals, these tools offer personalized recommendations and real-time adjustments.

Unlike traditional budgeting methods that require manual tracking, AI-powered solutions automate the process, reducing the chances of human error while improving efficiency.

One of the most significant advantages of AI in budgeting is its ability to identify spending patterns. AI algorithms analyze past transactions and detect trends, allowing users to see where their money is going.

This insight helps individuals make more informed decisions about their financial habits and adjust their budgets accordingly.

Automated Expense Tracking and Categorization

Manually tracking expenses can be tedious and time-consuming, but AI streamlines this process by automatically categorizing transactions.

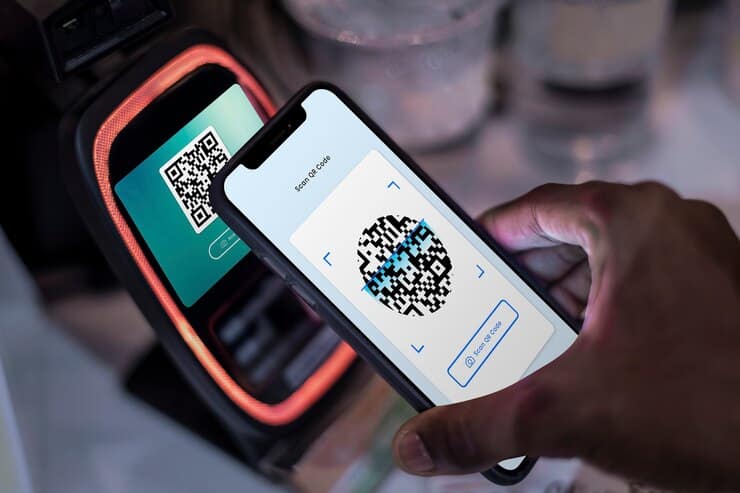

AI-powered budgeting apps connect to bank accounts, credit cards, and digital wallets to track every expense in real time.

These tools classify expenses into predefined categories such as groceries, rent, entertainment, and transportation, providing users with a clear breakdown of their spending.

Additionally, AI continuously learns from a user’s financial behavior, improving accuracy over time. If an expense is misclassified, the user can correct it, and the AI system will adjust its categorization in the future.

This automation eliminates guesswork and ensures accurate financial records, making budgeting more efficient and stress-free.

Smart Budgeting and Financial Planning

AI takes budgeting a step further by offering proactive financial planning features. Many AI-driven budgeting tools analyze historical spending patterns and suggest personalized budgets based on income, expenses, and savings goals.

Users receive alerts if they exceed their budget or if unusual spending is detected, allowing them to take immediate action.

Some AI tools even offer dynamic budgeting, adjusting monthly allocations based on real-time financial activity. For example, if a user spends less on dining out in one month, the AI may suggest reallocating the extra funds to savings or debt repayment.

This adaptability makes budgeting more flexible and realistic, ensuring that financial goals remain achievable.

Predictive Financial Insights and Goal Setting

One of AI’s most powerful features is its ability to provide predictive financial insights. By analyzing spending patterns and external factors such as inflation or upcoming bills, AI can forecast future financial trends.

This predictive capability helps users prepare for potential financial challenges and optimize their savings strategies.

AI-powered budgeting apps also assist with goal setting by calculating the exact amount users need to save for specific objectives, such as buying a car, traveling, or building an emergency fund. These tools provide progress updates and suggest adjustments to ensure users stay on track, making financial goal-setting more effective and motivating.

Security and Privacy Considerations

While AI-powered budgeting tools offer numerous benefits, security and privacy remain critical concerns. Most reputable financial apps use encryption and multi-factor authentication to protect sensitive data.

Users should ensure they choose AI budgeting tools with strong security measures and transparent data privacy policies.

It’s also important to review app permissions and avoid granting unnecessary access to personal information. By using secure and well-reviewed AI-powered budgeting tools, users can enjoy the benefits of smart financial management while safeguarding their personal data.

The Future of AI in Personal Budgeting

As AI technology continues to evolve, the future of personal budgeting looks promising. Emerging innovations such as voice-activated financial assistants, blockchain integration, and even AI-driven investment recommendations will further enhance financial management.

In the coming years, AI is expected to become even more intuitive, providing users with highly personalized financial advice tailored to their evolving needs.

AI-powered budgeting tools are not just about tracking expenses; they empower users to take control of their finances, make informed decisions, and work toward long-term financial stability.

With continuous advancements in AI, the way people manage money is undergoing a revolutionary transformation, making financial planning more accessible, efficient, and insightful.